Irs 2025 Income Tax Brackets Head Of Household

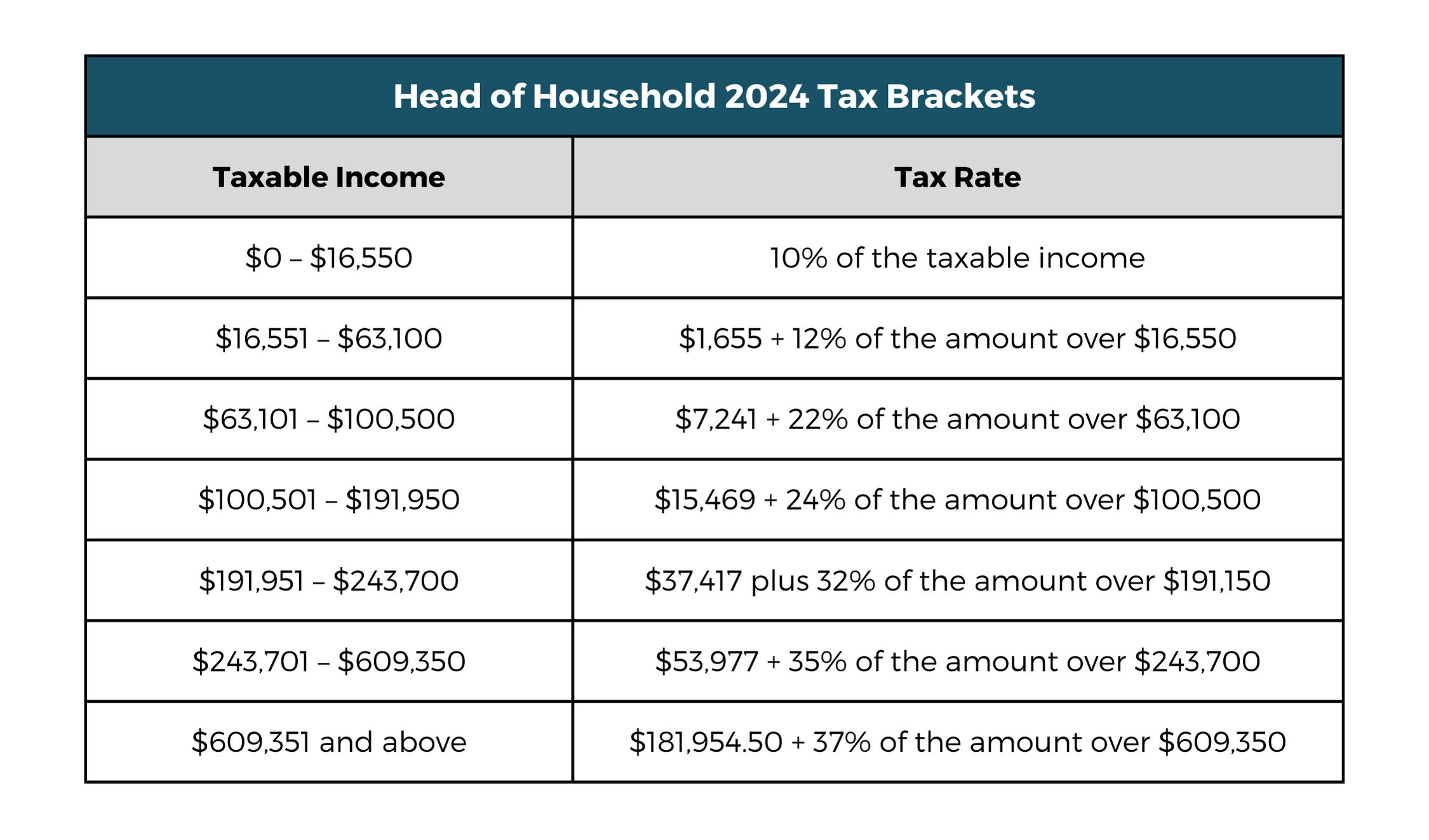

Irs 2025 Income Tax Brackets Head Of Household. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. See current federal tax brackets and rates based on your income and filing status.

There are seven different income tax rates: There are seven (7) tax rates in 2025.

In 2025, The Federal Income Tax.

In 2023 and 2025, there are seven federal income tax rates and brackets:

There Are Seven Tax Brackets For Most Ordinary Income For The 2023 Tax Year:

Fact checked by kirsten rohrs schmitt.

Page Last Reviewed Or Updated:

Images References :

Source: sherrywdru.pages.dev

Source: sherrywdru.pages.dev

2025 Standard Deductions And Tax Brackets Helene Kalinda, There are seven (7) tax rates in 2025. Fact checked by kirsten rohrs schmitt.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2025 Elene Hedvige, Thankfully, the irs released the income tax brackets for 2025 last year, allowing you to strategize. In 2023 and 2025, there are seven federal income tax rates and brackets:

Source: taliaqjoleen.pages.dev

Source: taliaqjoleen.pages.dev

Irs Tax Brackets 2025 Head Of Household Eleen Harriot, The 2025 tax year features federal income tax rates, ranging from 10% to 37%. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: rgwealth.com

Source: rgwealth.com

2025 Tax Code Changes Everything You Need To Know RGWM Insights, In 2025, the federal income tax. The irs is introducing new income limits for its seven tax brackets,.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2025 Elene Hedvige, The irs is introducing new income limits for its seven tax brackets,. Find out how much you’ll pay in federal income taxes.

Source: liesaqrivkah.pages.dev

Source: liesaqrivkah.pages.dev

Tax Brackets 2025 Single Meggi Aveline, 2025 federal income tax brackets and rates. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: evvieqgwendolen.pages.dev

Source: evvieqgwendolen.pages.dev

2025 Tax Brackets Wilma Juliette, Married couples filing separately and head of household filers; The brackets will apply to taxes filed in 2025 on income earned in 2025.

Source: jacquenettewciel.pages.dev

Source: jacquenettewciel.pages.dev

Tax Bracket Head Of Household 2025 Aaren Annalee, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: jeaninewfred.pages.dev

Source: jeaninewfred.pages.dev

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, Married couples filing separately and head of household filers; There are seven tax brackets for most ordinary income for the 2023 tax year:

Source: fanyaqkarmen.pages.dev

Source: fanyaqkarmen.pages.dev

Federal Tax Withholding 2025 Kaile Marilee, What are the 2025 tax brackets? The income threshold for each bracket was.

Here Are The 2025 Federal Tax Brackets.

The government uses these brackets to determine how much tax you owe, based on how much you earn and your slice (s) of pie.

Each Rate Corresponds To Specific Income Ranges, Which Have Been Adjusted For.

See current federal tax brackets and rates based on your income and filing status.