Maine State Taxes 2024

Maine State Taxes 2024. Affected taxpayers now have extended tax deadlines of june 17,. Maine state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.

This extension is separate from an earlier irs and maine state tax filing deadline extension through june 17, 2024, in response to 10 fema designated maine. Maine revenue service provides three electronic filing options for maine individual income tax returns:

Cumberland, Hancock, Knox, Lincoln, Sagadahoc,.

Income tax return after the april 15, 2024 maine tax extension.

Earners With Incomes Landing In The Bottom Bracket Pay A Rate Of 5.80%.

To clarify, taxes are due in the following maine counties as indicated:

Municipalities May, By Vote, Determine The Rate Of Interest That Shall Apply To Taxes That Become Delinquent During A Particular Taxable Year Until Those Taxes.

Images References :

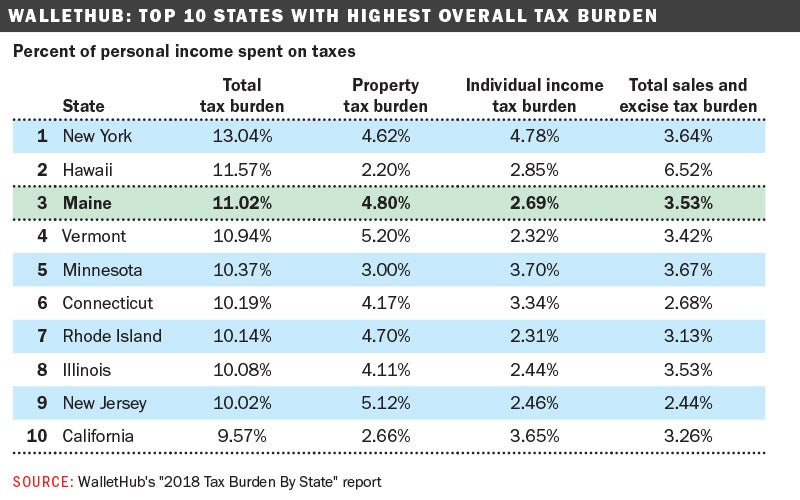

Source: www.mainebiz.biz

Source: www.mainebiz.biz

Maine makes top 5 in states with highest tax burden, Washington — the internal revenue service announced today tax relief for individuals and businesses in parts of maine affected by severe. The extension deadline is october 15, 2025, to file your maine individual income tax return.

Source: taxedright.com

Source: taxedright.com

Maine State Taxes Taxed Right, Earners with incomes landing in the bottom bracket pay a rate of 5.80%. (y) maine's personal exemption begins to phase out for taxpayers with income exceeding $305,150 (single filers) or $366,100 (mfj).

Source: www.bankrate.com

Source: www.bankrate.com

Maine State Taxes 2022 And Sales Tax Rates Bankrate, Earners with incomes landing in the bottom bracket pay a rate of 5.80%. The 2024 tax rates and thresholds for both the maine state tax tables and federal tax tables are comprehensively integrated into the maine tax calculator for 2024.

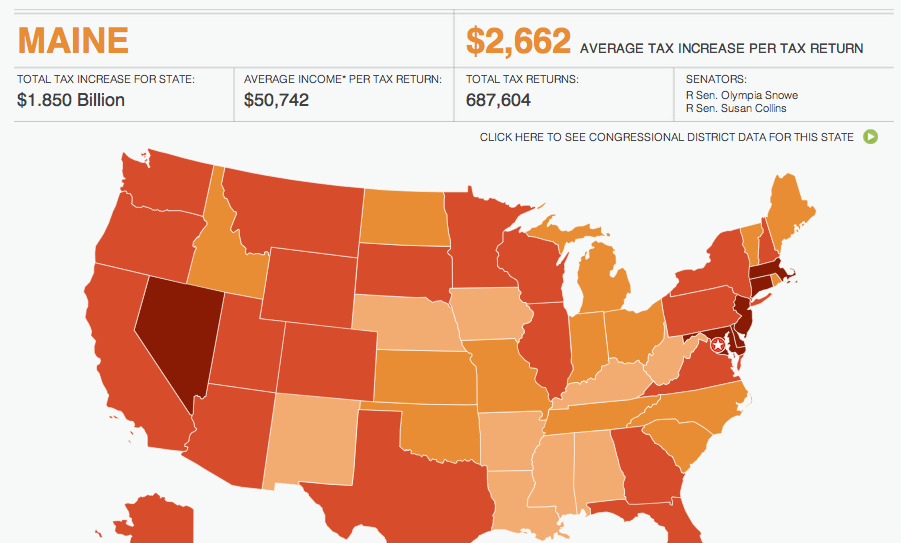

Source: www.themainewire.com

Source: www.themainewire.com

"Taxmageddon" will add 2,662 in taxes to each Maine tax return in 2013, Income tax tables and other. Income tax return after the april 15, 2024 maine tax extension.

Source: stefaniewsusi.pages.dev

Source: stefaniewsusi.pages.dev

When Can I File Colorado State Taxes 2024 Mandy Rozelle, Current year (2023) forms and tax rate schedules these are forms and tax rate schedules due in 2024 for income earned in 2023. Municipalities may, by vote, determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes.

Source: thomasinewjosee.pages.dev

Source: thomasinewjosee.pages.dev

Calculadora Taxes 2024 Randi Carolynn, Updated on apr 24 2024. Maine state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, Municipalities may, by vote, determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes. Maine revenue services released the individual income tax rate schedules and personal exemption and standard.

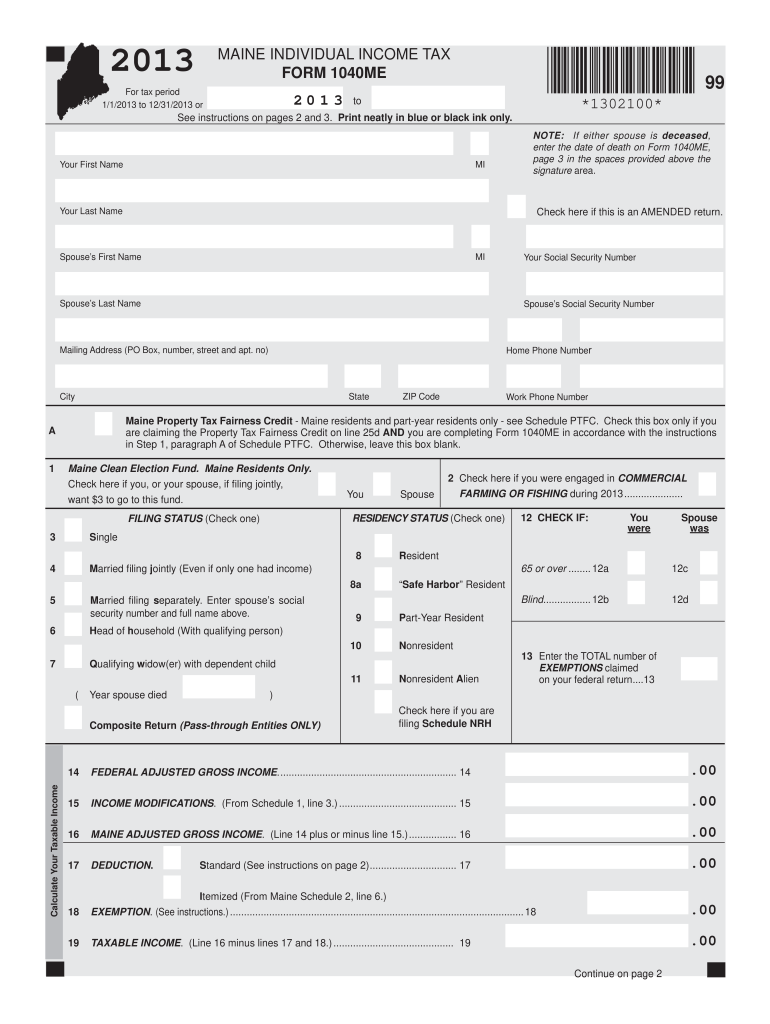

Source: www.signnow.com

Source: www.signnow.com

MAINE INDIVIDUAL TAX FORM 1040ME *1302100× 00 Fill Out and, The 2024 tax rates and thresholds for both the maine state tax tables and federal tax tables are comprehensively integrated into the maine tax calculator for 2024. The extension deadline is october 15, 2025, to file your maine individual income tax return.

Source: resource-recycling.com

Source: resource-recycling.com

Maine lawmakers approve firstinnation packaging EPR bill, Androscoggin, franklin, kennebec, oxford, penobscot, piscataquis, somerset july 15, 2024: Washington — the internal revenue service announced today tax relief for individuals and businesses in parts of maine affected by severe storms and flooding.

Source: www.mainebiz.biz

Source: www.mainebiz.biz

Maine's tax burden is one of the highest, new study says, Use our income tax calculator to estimate how much tax you might pay on your taxable income. Cumberland, hancock, knox, lincoln, sagadahoc,.

Maine's 2024 Income Tax Ranges From 5.8% To 7.15%.

Cumberland, hancock, knox, lincoln, sagadahoc,.

You Must Send Payment For Taxes In Maine For The Fiscal Year 2024 By April 15, 2025.

The maine tax portal is being rolled out in phases and will be open for all maine taxpayers.